Until the start of the special military operation, Russia had one of the least regular foreign trade statistics in the world. Russian billionaires pumped profits out of Russia at large, and the deviations mirror statistics from Russian official data amounted to tens of billions of dollars a year

Sanctions of the collective West) on Russian billionaires and the Russian economy had two huge positive effects on the Russian economy: (1) it is impossible to pump profits out of Russia „at large“ and (2) a major trade reorientation of Russia from trade with developed countries to trade with the global South has been carried out.

Mirror statistics are applied here only for the years 2022 and 2023, although it would be more correct to use these data for earlier years as well, in order to assess real changes in the dynamics of foreign trade, and not just estimate dynamics in the last two years compared to earlier official data

The calculated data deviates upwards in relation to the estimates made by the WTO for several reasons: (1) gas exports to Germany are not booked as exports from Russia, which had an effect of $78 billion in 2022 and $35 billion in 2023; (2) the trade of many countries in Africa and Asia is not reported to the WTO for 2023, (3) the trade of countries under sanctions, such as Cuba, Iran, Afghanistan, does not exist for more than the last two years (4) data on the trade of Belarus they are not reported

Russia mostly exports energy and material raw materials, and the sanctions of the collective West could not stop their exports, but only redirected them to other countries. Therefore, the changes in export values in 2022 (a huge increase) and in 2023 (a big drop) were the consequences of changes in the prices of primary products, and not of the applied policies against the Russian economy.

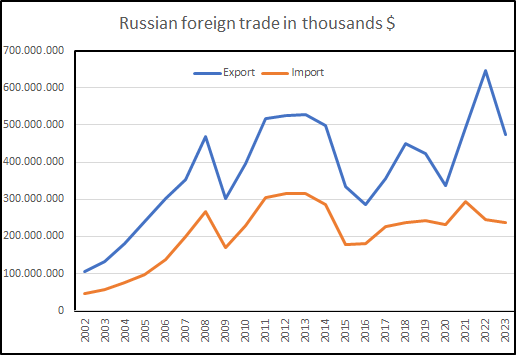

According to the performed calculations, Russia had an increase in the value of exports from 492 billion dollars in 2021 to a record 647 in 2022 (578 according to WTO) and decrease to 474 billion dollars in 2023.

Import were reduced from 293.5 billion dollars in 2021 to 245.5 billion dollars in 2022 . and 236.5 billion in 2023.

The trade surplus increased from 198.8 billion dollars in 2021 to 401.6 billion in 2022 and decreased to 237.2 billion in 2023.

The biggest structural change is the growth of the relative importance of China and India for Russia’s trade:

- China increased its share in Russia’s total exports from 14% in 2021 to 27% in 2023, and increased its share in Russia’s imports from 24.8% in 2021 to 47% in 2023

- India has increased its share in Russia’s total exports from 1.9% in 2021 to 12.9% in 2023.

Russia’s exports decreased by 18.6 billion dollars in 2023, compared to 2021.

In this total decrease, it increased the most in China (59.8), India (52.1), Turkey (19.2), Hong Kong, China (6.6), Germany (5.8), Brazil (4.7), UAE (3.1), Hungary (2.5), Singapore (1.9) and Indonesia ($1.5 billion).

Exports to Serbia increased by 439 million dollars and it is in 22nd place in terms of this increase in value. In Bulgaria it increased by 836 million dollars, in North Macedonia for 184, in BiH for 147 and in Montenegro for 3.2 million dollars. We repeat, here the Russian official data from 2021 and the partner’s data in 2023 are compared, which is not the same, neither if they knew the Russian data, nor if they looked only at the partner’s data

The biggest drop in the value of exports was to the Netherlands (an off-shore center for money laundering and registration of „foreign direct investments“) by 38 billion dollars, and to the UK by 21.9 (mostly gold exports), Italy (14 ,9), Poland (14.3), USA (12.8), Finland (8.2), Ukraine (8.1), South Korea (8), France (6) and Belgium ($4.6 billion

Excluding Ukraine, the largest relative decline in the value of exports was in Malta (99.9%, from 2,359 to 1.1 million dollars), the UK (-98, 4%), Austria (-97.9%), Sweden (-96.6%) and Estonia (-95.8%).

Is such a drop in exports harmful to the Russian economy, if profits were laundered through invoices (e.g. Malta) or gold was exported (UK) or supplied to foreign refineries for oil processing?

In 2021, Serbia was in 53rd place, according to the value of exports from Russia, and in 2023, it advanced to 40th place, where it is from its neighbor Bulgaria to 23rd. It increased its negligible share in Russian exports from 0.26% to 0.36%.

Russia reduced imports by $57 billion in 2023 compared to 2021

Russia increased the value of imports from 18 countries, among which Serbia is in 14th place according to the value of growth (by 138.4 million dollars). In total, the value increased by 56.5 billion dollars, mostly from China (38.4), Turkey (4.4), UAE (2.3), Hong Kong, China (2.1), Latvia (1, 8), Lithuania (1.7), Armenia (1.7), Kazakhstan (1.6), Uzbekistan (0.9) and Kyrgyzstan ($0.7 billion

In 2021, Serbia was in 38th place according to Russia’s imports, and in 2023 it reached 27th place and increased its share in total imports from 0.36% to 0.51%.

Russia has reduced the value of imports from more than 100 countries, which is more a consequence of the reduction in prices of primary products, and less of direct collective West sanctions. We mean the number of countries, not the value.

The biggest decrease in the value of imports was from Germany (23.6), USA (16.7), France (10) , Italy (7), South Korea (6.9), Japan (6.3) and Ukraine ($4.2 billion).

Based on the movement of primary product prices we can estimate that goods exports will be worth over 450 billion dollars this year, imports up to 250 billion dollars with a trade surplus of 200 billion dollars. The data will be very similar to the data from 2021. The structure of that data has been drastically, and forever, changed.

Макроекономија Економске анализе, Србија, окружење, и међународна економија

Макроекономија Економске анализе, Србија, окружење, и међународна економија